You’ve decided to protect your assets. Now, finding the Best States for E-commerce LLCs is your priority. But where should you form it?

Now comes the confusing part: Where should you form it?

Do you open it in your home state? Or do you listen to the internet gurus who scream “Wyoming is a tax haven!” or “Delaware is the Gold Standard!”?

In 2026, the answer is not simple.

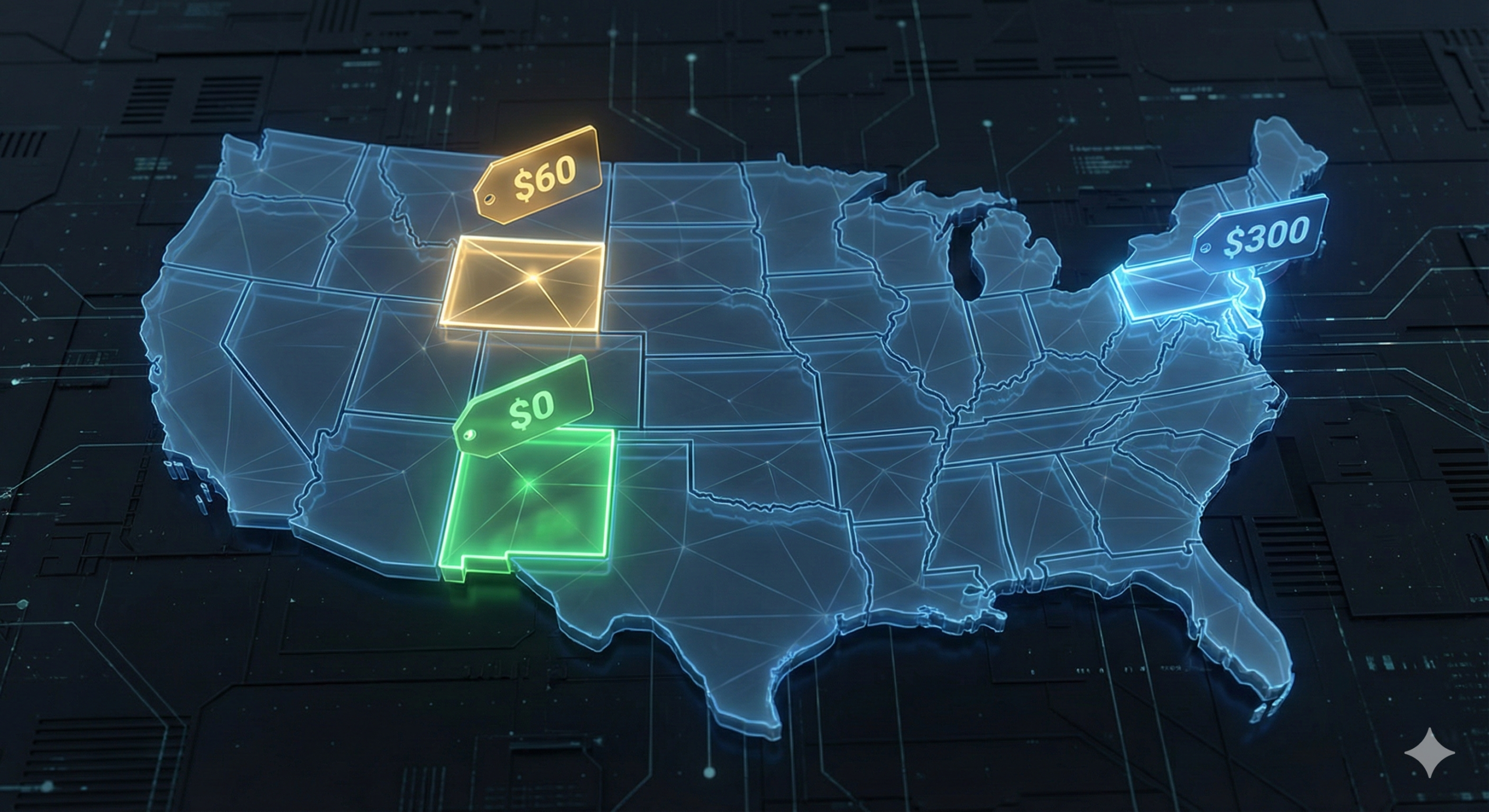

If you choose wrong, you could end up paying double taxes (Foreign Qualification) or spending $300/year on unnecessary fees.

Here is the definitive guide to the Best States for E-commerce LLCs, comparing the titans: Wyoming, Delaware, and the hidden gem, New Mexico.

The “Home State” Rule: The #1 Mistake Sellers Make

Before we look at Wyoming, we must address the elephant in the room.

If you live in California, Texas, Florida, or New York, and you run your Amazon business from your kitchen table…

You are “doing business” in your home state.

The Trap

If you form a Wyoming LLC but live in California:

- You pay Wyoming fees ($60/year).

- AND you must register your Wyoming LLC as a “Foreign Entity” in California.

- AND you must pay the California Franchise Tax ($800/year).

Result: You pay double. You complicate your life.

- The Rule: For most US residents, forming an LLC in your home state is usually the cheapest and legally correct option.

Exceptions: If you are a Digital Nomad (no fixed address) or a Non-US Resident, then the “Best State” debate is crucial for you.

1. Wyoming: The E-commerce Favorite 🤠

When searching for the Best States for E-commerce LLCs, Wyoming is the ‘Switzerland of the Rockies” It invented the LLC in 1977 and is designed for small business owners, not giant corporations.

- Cost: ~$100 to form. $60/year to maintain.

- Privacy: High. They do not publish member names.

- Asset Protection: Strong. It has “Charging Order Protection” for Single-Member LLCs (harder for creditors to seize your business).

- Verdict: The #1 choice for Digital Nomads, Crypto sellers, and Non-US Residents. It’s cheap, private, and banks love it (Mercury/Relay work great here).

2. Delaware: The “Startup” Trap 🏢

Everyone talks about Delaware. Why? Because lawyers make money there.

Delaware is designed for corporations like Facebook or Uber that plan to raise Venture Capital or go public (IPO).

- Cost: ~$90 to form. $300/year Franchise Tax (Minimum!).

- Privacy: Moderate.

- The Problem: The “Court of Chancery” is great for complex lawsuits, but expensive for you. Unless you plan to sell shares to investors, Delaware is overkill and overpriced for a simple Shopify store.

3. New Mexico: The “Hidden Gem” 💎

New Mexico is the unsung hero of 2026. It is the only state that rivals Wyoming.

- Cost: ~$50 to form. $0/year (Yes, Zero).

- Privacy: Extreme. They don’t even ask for member names on the filing forms.

- Maintenance: No Annual Report required.

- Verdict: If you want a “Set it and forget it” LLC. Perfect for holding privacy assets. However, Wyoming has a stronger banking reputation for international founders.

Comparison of the Best States for E-commerce LLCs (2026 Data)

Below is the breakdown regarding the Best States for E-commerce LLCs based on filing fees and privacy:

| Feature | Wyoming | New Mexico | Delaware |

| Best For | E-commerce / Nomads | Privacy / Low Budget | VC Startups |

| Filing Fee | ~$100 | $50 | ~$90 |

| Annual Fee | $60 | $0 | $300+ |

| Annual Report? | Yes (Simple) | No | Yes |

| State Income Tax | 0% | 0% (for non-residents) | 0% (for non-residents) |

| Anonymity | High | Very High | Moderate |

The “Anonymous LLC” & Privacy

In 2026, privacy is a luxury.

While the federal “CTA” reporting is currently in limbo (suspended for domestic entities), states like New York are introducing their own transparency laws.

Wyoming and New Mexico allow you to use a Nominee Service or just a Registered Agent address.

- Benefit: When a customer searches your company name, they see “Registered Agent, Cheyenne, WY,” not “Your Name, 123 Home Street.”

- Cost: A Registered Agent costs about $50-$100/year. (Services like Northwest Registered Agent or Bizee are popular).

For Non-US Residents (The “ETBUS” Loophole)

If you live in Spain, Colombia, or anywhere outside the US:

- You Do Not pay US Income Tax if you have no “US Trade or Business” (no US employees, no US warehouse you own).

- Wyoming is your best friend. It gives you a US bank account (Stripe/PayPal access) and credibility.

- Warning: You must still file Form 5472 every year. The penalty for forgetting is $25,000.

Summary: Which of the Best States for E-commerce LLCs Should You Pick?

- US Resident: The list of Best States for E-commerce LLCs doesn’t apply if you live in CA or NY. Stick to your home state.

- Digital Nomad / Non-US Resident: Wyoming is the winner (Banking + Low Fees). New Mexico is a close second (Cheapest).

- Future Unicorn: Only choose Delaware if investors demand it.

Ready to start? Check our guide on Sole Proprietorship vs LLC to review the risks. Once you have your LLC, learn how to open a bank account in our [Mercury vs Relay Financial] review.