You opened your Etsy shop to escape the 9-to-5 grind, not to become an accountant. But there is a dangerous trap waiting for new entrepreneurs, and it usually springs shut in April.

It’s called the “Underpayment Penalty.”

Most people believe the myth that Etsy estimated taxes are a once-a-year event. If you have a regular day job, that’s true—your boss withholds taxes from every paycheck. But now that you are a business owner, you are the boss. And the IRS demands that you pay your taxes as you earn them, not months later.

If you wait until April 15th to pay everything you owe from your Etsy sales, you will likely be hit with a mandatory penalty fee plus interest.

Here is the comprehensive, bulletproof strategy to handling 2026 Quarterly Estimated Taxes, updated with the new “One Big Beautiful Bill” (OBBBA) legislation.

The “Pay-As-You-Go” System: Do You Have To Pay?

The US tax system operates on a “pay-as-you-go” basis. The IRS does not like waiting for its money.

You are legally required to make quarterly estimated tax payments if you meet BOTH of these conditions:

- You expect to owe at least $1,000 in tax for the 2026 tax year (after subtracting your withholding and credits).

- You expect your withholding and credits to be less than the smaller of:

- 90% of the tax to be shown on your 2026 return.

- 100% of the tax shown on your 2025 return.

Translation: If your Etsy shop is profitable and you are making more than a few thousand dollars in profit a year, you likely fall into this trap.

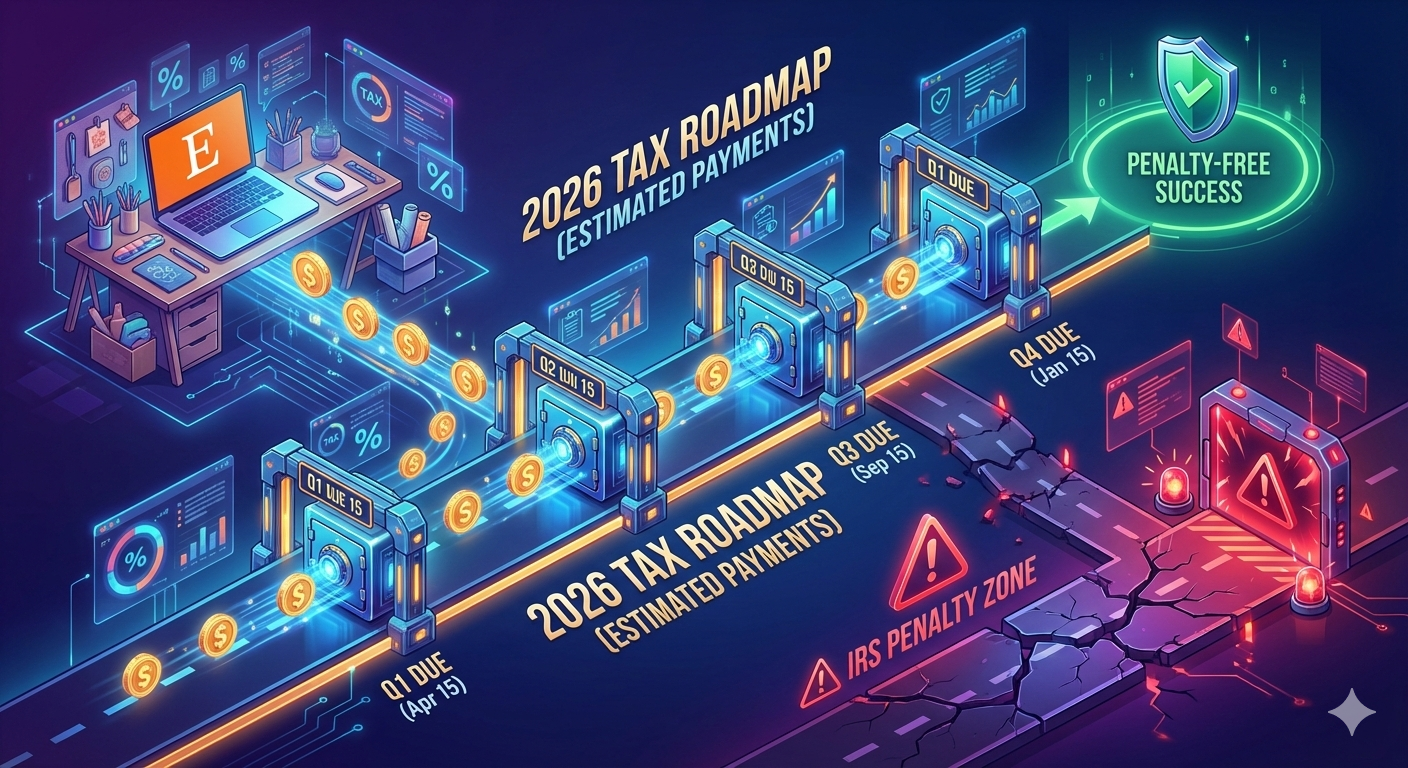

The 2026 Quarterly Deadlines (Strict Enforcement)

Missing a deadline isn’t just an “oops” moment; it triggers the interest clock. The IRS calculates penalties based on the number of days you are late.

Mark these critical dates on your calendar immediately. Note that the quarters are not all three months long (a confusing quirk of the system).

| Payment Period | Earnings From… | Payment DUE Date |

| Q1 | Jan 1 – March 31 | April 15, 2026 |

| Q2 | April 1 – May 31 | June 15, 2026 |

| Q3 | June 1 – Aug 31 | September 15, 2026 |

| Q4 | Sept 1 – Dec 31 | January 15, 2027 |

Warning: The gap between Q1 and Q2 is only two months, catching many sellers off guard. However, the gap between Q3 and Q4 gives you four months to save.

How to Calculate Your Payments (The “Napkin Math”)

Calculating what you owe can feel overwhelming, but you only need to estimate two things: Income Tax and Self-Employment Tax.

1. The Self-Employment Tax (The Heavy Hitter)

This is the tax that catches everyone by surprise. It is a flat 15.3% on your net profit.

- 12.4% for Social Security (capped at $184,500 of income for 2026).

- 2.9% for Medicare (unlimited).

2. The Income Tax (Updated for OBBBA 2026)

Thanks to the “One Big Beautiful Bill Act” (OBBBA), the tax brackets and deductions have shifted in your favor for 2026.

- New Standard Deduction: For 2026, you don’t pay federal income tax on the first $16,100 (Single) or $32,200 (Married Filing Jointly). This is a massive shield for your earnings.

- QBI Deduction is Permanent: The 20% “Pass-Through” deduction is now permanent. This means you effectively don’t pay income tax on 20% of your Etsy profits.

Example Scenario:

If you profit $10,000 on Etsy and have no other income:

- SE Tax: $1,530 (15.3%)

- Income Tax: $0 (Because $10,000 is less than the $16,100 standard deduction).

- Total Owed: $1,530.

- Since this is >$1,000, you must pay quarterly.

The “Safe Harbor” Secret Strategy

Terrified of calculating the wrong number and getting fined? Use the Safe Harbor Rule. This is the IRS’s “Get Out of Jail Free” card.

You will NOT be charged an underpayment penalty if you simply pay 100% of the tax you owed last year (divided by 4), even if you make a million dollars this year.

- The Strategy: Look at “Total Tax” on your 2025 Form 1040 (Line 24). Divide that number by 4. Send that amount each quarter.

- The Result: You might still owe more in April if you had a great year, but you will be immune to penalties.

Note for High Earners: If your AGI was over $150,000 last year, you must pay 110% of last year’s tax to qualify for Safe Harbor.

How the New “OBBBA” Laws Help Etsy Sellers

The 2026 tax landscape has changed significantly. Here is how the new laws help you lower those quarterly payments:

- Permanent Bonus Depreciation: Did you buy a $2,000 laptop or a $3,000 laser cutter for your shop? The OBBBA restored 100% bonus depreciation. You can deduct the entire cost immediately in Q1, drastically lowering your estimated tax payment for that quarter.

- Overtime Deduction: If you have a day job and work overtime to fund your Etsy shop, the new law allows you to deduct up to $12,500 of overtime pay. This lowers your overall tax bracket, potentially reducing what you owe on your Etsy side hustle.

How to Pay (Don’t Write a Check)

Stop using snail mail. It is slow, insecure, and easy to lose. Use these instant electronic methods:

- IRS Direct Pay: The best option for individuals. It pulls money directly from your checking account. No registration required. Select “Estimated Tax” and the correct tax year (2026).

- EFTPS (Electronic Federal Tax Payment System): Better for serious businesses, but requires a PIN and registration.

- Your Online Account: You can log in to your IRS.gov account to see payment history and make payments.

Summary: Your Quarterly Action Plan

Don’t let tax anxiety paralyze your business growth. Follow this simple protocol:

- Check your profit at the end of every quarter.

- Set aside 25-30% of that profit into a separate “Tax Savings” bank account.

- Pay the IRS on the 4 deadlines using IRS Direct Pay.

- Use the Safe Harbor method if your income is unpredictable.

By treating these payments as just another mandatory business expense—like shipping or Etsy fees—you protect your profits and keep the IRS happy.

Now that you know when to pay, ensure you are paying the minimum amount possible. Read our guide on Deducting Every Etsy Fee Possible or check the 2026 1099-K Thresholds to see if you will receive a form this year.