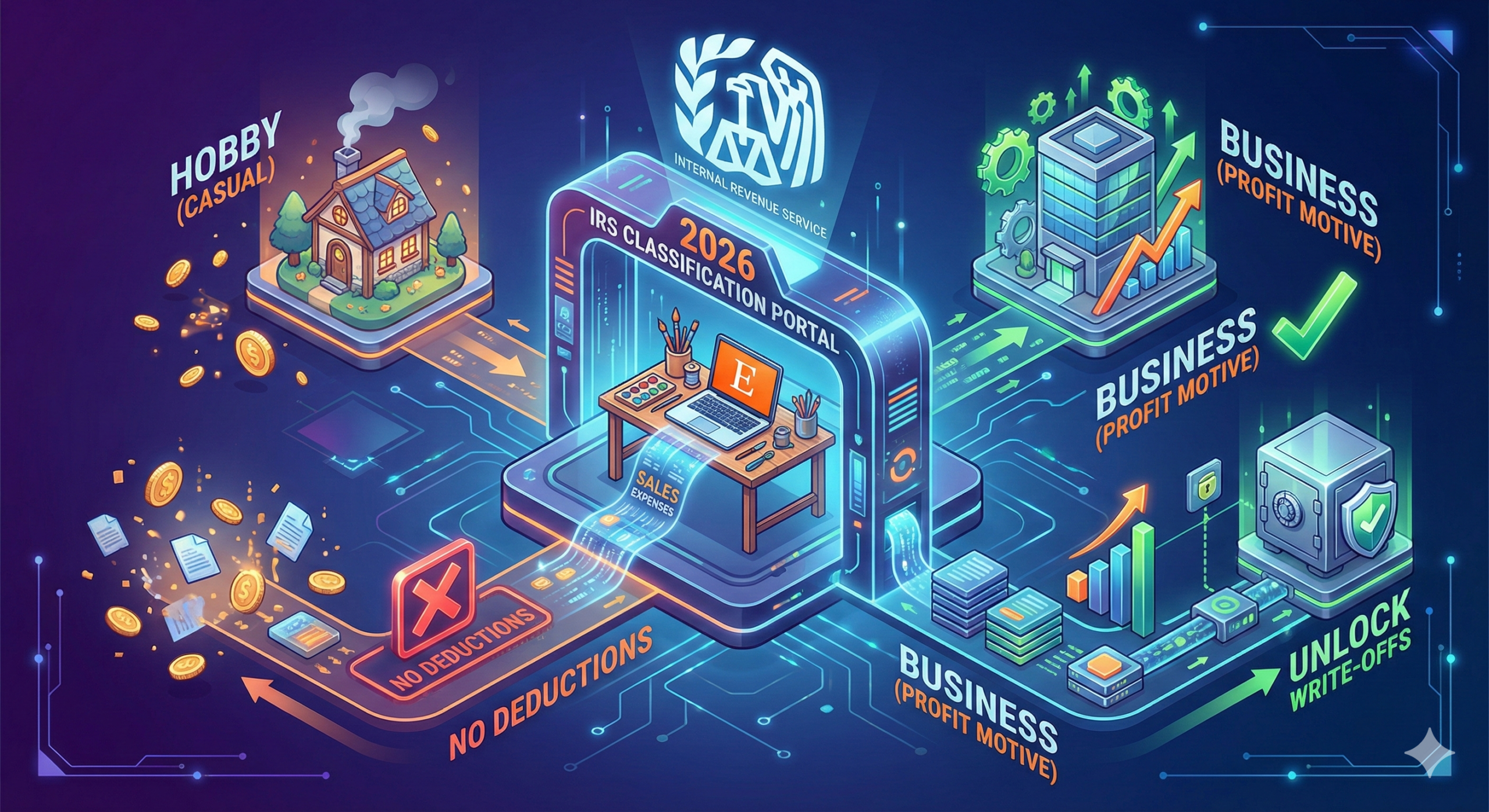

Starting an online shop is exciting, but understanding the Etsy hobby vs business distinction is the most critical tax step you will take. Whether you knit scarves or sell digital planners, the IRS classification determines if you can deduct expenses or if you’ll be stuck paying taxes on 100% of your income.

The answer determines whether you can deduct your expenses or if you’ll be stuck paying taxes on 100% of your income without relief.

With the new “One Big Beautiful Bill” (OBBBA) making strict tax changes permanent starting in 2026, getting this classification right is more critical than ever. Here is everything Etsy sellers need to know to stay safe and profitable.

The Core Etsy Hobby vs Business Tax Difference

The distinction between a “Hobby” and a “Business” isn’t just about how much money you make; it’s about intent.

- ✅ Business: You operate with the primary intention of making a profit.

- The Benefit: You can deduct “ordinary and necessary” expenses (Etsy fees, shipping, materials, home office). If your business loses money, you can use that loss to lower your taxes from other jobs (like your W-2 salary).

- ❌ Hobby: You operate primarily for pleasure or recreation.

- The Problem: You must report every dollar of income, but you cannot deduct expenses.

The “OBBBA” Impact for 2026

Before 2018, hobbyists could deduct expenses up to the amount of their income. The Tax Cuts and Jobs Act (TCJA) eliminated this. Now, the new OBBBA legislation has made this permanent.

What does this mean for you?

If you sell $5,000 worth of crafts but spent $4,000 on materials and fees:

- As a Business: You pay taxes on only $1,000 (Profit).

- As a Hobby: You pay taxes on the full $5,000. The $4,000 in costs is gone.

The IRS “9 Factors” Test

How does the IRS decide? They look at the “facts and circumstances” using these 9 specific factors. You don’t need to satisfy all of them, but the more you hit, the safer you are.

- Businesslike Manner: Do you keep accurate books? Do you have a separate business bank account? (This is the easiest one to fix today!).

- Expertise: Do you have the knowledge to be successful, or are you learning as you go?

- Time and Effort: Are you putting in consistent hours to make it grow?

- Expectation of Appreciation: Do you expect your assets (like equipment) to increase in value?

- Success in Other Activities: Have you turned other hobbies into businesses before?

- History of Income/Loss: Are losses due to startup costs, or are they never-ending?

- Profits: Have you made a profit in some years?

- Financial Status: Do you depend on this income to pay your bills? (If yes, it looks more like a business).

- Personal Pleasure: Is this something you’d do for free just for fun? (Like knitting for family).

The “Safe Harbor” Rule (3 out of 5 Years)

The IRS offers a shortcut called the Safe Harbor Rule.

If your shop turns a profit in 3 out of the last 5 consecutive tax years, the IRS presumes you are a business. The burden of proof shifts to them to prove otherwise.

- Note: It doesn’t have to be a huge profit. Even $1 of profit counts for this rule.

How to Protect Your “Business” Status (Action Steps)

If you are worried you might be classified as a hobby, take these steps immediately to prove your intent to profit:

1. Separate Your Finances

Never mix personal and business money. Open a dedicated checking account for your Etsy payouts and expenses. This is “Factor #1” in action.

2. Keep Serious Records

Don’t just rely on your Etsy dashboard. Use accounting software (like QuickBooks or a spreadsheet) to track every penny. Save your receipts digitally.

3. Treat It Like a Job

Set a schedule. Create a business plan (even a one-page simple one). Show that you are trying to cut costs or increase sales to become profitable.

Summary: Hobby vs. Business Comparison

| Feature | Business ✅ | Hobby ❌ |

| Goal | Profit | Pleasure/Recreation |

| Report Income? | Yes (Schedule C) | Yes (Other Income) |

| Deduct Expenses? | Yes (Fully Deductible) | No (0% Deductible) |

| Self-Employment Tax | Yes (If profit > $400) | No |

| Risk | Audit risk if losses are constant | Taxing gross income |

Disclaimer: I am an AI, not a CPA or tax attorney. Tax laws, including the OBBBA provisions, are complex and subject to change. Always consult with a qualified tax professional before filing.

Want to know exactly what you can deduct? Read our guide on Deducting Etsy Fees here